Correlation vs Regression: decoding the differences in Data Analysis. Discover the key distinctions between correlation and regression, two fundamental concepts in statistics. This blog explains how they differ in purpose, methodology, and application in data interpretation and predictive modelling.

Home Resources Data, Analytics & AI Correlation vs Regression: Understanding the Difference

Regression Analysis Training Top Rated Course

Exclusive 40% OFF

Enquire Now Download curriclumWe ensure quality, budget-alignment, and timely delivery by our expert instructors.

-->

In this age, where data is so abundantly being generated, there are statistical techniques that break these datasets down into variables to help us understand them. To understand how the statistical tools help us understand these variables, we need to understand the critical difference between Correlation vs Regression.

While both are essential tools in the field of statistics, they serve different purposes and offer unique insights. In this blog, you are going to learn about the differences between Correlation vs Regression, how they are similar to each other and how they are helping businesses and research.

Table of Contents

1) What is Correlation?

2) What is Regression?

3) Critical differences between Correlation vs Regression

4) Similarities between Correlation and Regression

Correlation is a statistical measure that gauges the strength and direction of a relationship if it exists between two variables. It quantifies the extent to which changes in one variable correspond to changes in another, offering valuable insights into patterns within data sets. The Correlation coefficient, often denoted as 'r', ranges from -1 to +1.

A positive Correlation (ranging from 0 to +1) signifies a direct relationship: as one variable increases, so does the other. Conversely, a negative Correlation (ranging from 0 to -1) indicates an inverse relationship: as one variable increases, the further decreases. There can also be zero Correlation between the two variables. This Correlation signifies that there is a null relationship between them. It is in this Correlation when a change in one variable does not affect the other. The following image will help you to understand them better:

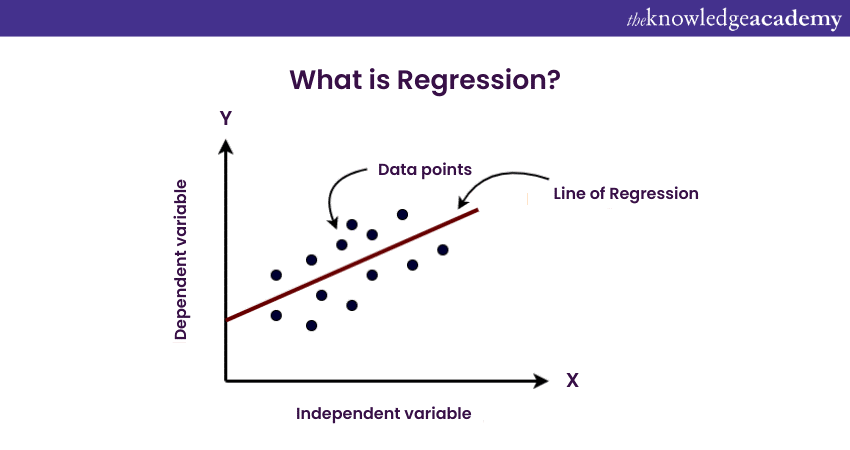

Regression helps in understanding the underlying structure of the data by fitting a mathematical model to observed points. Regression Analysis comes in different forms, such as linear and non-linear Regression, allowing statisticians and researchers to choose the most appropriate model for their specific data.

By deciphering intricate relationships and predicting future outcomes, Regression empowers decision-makers across diverse fields, making it a cornerstone of predictive analytics and informed decision-making processes. It goes a step further by formulating a precise equation that can predict the value of one variable based on the importance of others. This predictive power makes Regression invaluable in forecasting and trend analysis.

Correlation and Regression, though related, serve different purposes in the field of statistics. Understanding their fundamental differences is vital for accurate data interpretation and informed decision-making. In this section, we will dissect the difference between Correlation and Regression, shedding light on their distinct methodologies, interpretations, and applications.

Aspect

Correlation

Regression

Purpose

Measures strength and direction of the relationship

Predicts and models the relationship

Variables

Two variables (equal roles)

Independent and dependent variables

Calculation

Correlation coefficient (r)

Regression equation (y = mx + b)

Direction

+1 to -1 (positive, negative, no Correlation)

Positive, negative (strength and direction)

Causation

It does not imply causation

Can imply causation under controlled conditions

Handling outliers

Sensitive outliers can distort the Regression line

Data representation

The equation representing the relationship

Application

Descriptive, identifies patterns

Predictive, forecasts future values

Complexity

Variable complexity (simple to multivariate)

Interpretation

Limited to strength and direction

Detailed insights into the relationship

Hypothesis testing

Limited to Correlation significance

Tests coefficients' importance in the model

Time-series analysis

Limited predictive power

Helpful in forecasting future trends

Usage

Preliminary analysis, identifies associations

Prediction, modelling, understanding impact

Correlation primarily aims to assess the strength and direction of the relationship between two variables. It helps in determining whether and how strongly variables are related without implying causation. Correlation coefficients, represented by 'r', range from -1 to +1, where +1 indicates a perfect positive Correlation, -1 represents an ideal negative Correlation, and 0 indicates no Correlation.

Regression, on the other hand, not only evaluates the relationship between variables but also formulates a predictive model. It aims to understand how the change in one variable affects another, allowing for predictions based on this understanding. The Regression equation derived from the data enables forecasting and is used for modelling and making predictions about future observations.

In Correlation, the variables involved are treated equally, without distinguishing between independent and dependent variables. It also measures the degree of association between two variables, regardless of their roles in the relationship.

On the contrary, in Regression, variables are categorised as independent (predictor) and dependent (response) variables. The independent variable(s) are used to predict the values of the dependent variable. Regression Analysis provides insights into how changes in the independent variables affect the dependent variable, offering a predictive framework for decision-making.

Correlation coefficients are calculated using formulas such as Pearson's, Spearman's, or Kendall's Correlation coefficients. These coefficients indicate the strength and direction of the relationship between variables. Positive values signify positive Correlation, negative values indicate negative Correlation, and zero represents no Correlation.

However, Regression Analysis involves complex calculations to determine coefficients and constants in the Regression equation. The process includes minimising the sum of squared differences between observed and predicted values. The Regression equation (y = mx + b) represents the relationship between variables. In this equation, 'y' means the dependent variable, 'x' symbolises the independent variable, 'm' is the slope, and 'b' is the intercept.

Correlation is employed when researchers want to understand the nature and strength of relationships between variables without making predictions. It is widely used in fields like psychology, biology, and economics to identify patterns and dependencies between variables. For instance, psychologists might use Correlation to explore the relationship between study time and exam scores to understand academic performance patterns.

Regression, on the other hand, is applied when the goal is to predict outcomes and also understand the impact of changes in independent variables on the dependent variable. It finds applications in fields such as finance, engineering, and healthcare. Financial analysts, for example, use Regression to predict stock prices based on historical data, aiding investment decisions.

Both Correlation and Regression have their limitations and assumptions. Correlation does not imply causation; a strong Correlation between two variables does not mean one causes the other. Additionally, Correlation coefficients can be influenced by outliers, affecting the accuracy of the Correlation analysis.

On the other hand, Regression assumes a linear relationship between variables, which might not always be the case. Nonlinear relationships require nonlinear Regression techniques, adding complexity to the analysis. Moreover, Regression Analysis is sensitive to outliers and multicollinearity (high Correlation between independent variables), which can affect the reliability of the Regression model.

Correlation analysis is straightforward and provides a precise measure of the relationship's strength and direction. It is helpful for preliminary analysis identifying potential patterns in the data. However, it lacks the predictive power of Regression and cannot be used for making future projections.

Regression Analysis, on the other hand, offers predictive capabilities, allowing for the estimation of future values based on historical data. It provides important insights into the impact of independent variables on the dependent variable. However, it requires a deeper understanding of the data and underlying assumptions, making it more complex than Correlation analysis.

Correlation merely indicates the direction and strength of a relationship between variables. It answers questions like whether two variables increase or decrease together. Regression, on the other hand, not only reveals the direction but also predicts the magnitude of change in one variable concerning changes in another. It can answer questions like how much the dependent variable is expected to change for a unit change in the independent variable.

Correlation does not mean causation. Even though two variables are strongly correlated, it still does not mean that changes in one variable cause changes in the other. Regression, while not proving causation, can establish a causal relationship under controlled experimental conditions. It can show whether changes in the independent variable directly impact the dependent variable.

Correlation analysis results in a single value, the Correlation coefficient, which summarises the relationship between variables. It doesn't provide an equation or model representing the data. In contrast, Regression Analysis provides a mathematical equation (linear or nonlinear) that can represent the relationship between variables. This equation is a valuable tool for making predictions and understanding the relationship intuitively.

Correlation analysis does not assume homoscedasticity (equal variance of residuals) between variables. In Regression, homoscedasticity is an essential assumption for accurate predictions. If the variance of residuals (the differences between observed and predicted values) is consistent across all levels of the independent variable, the Regression model is homoscedastic. Heteroscedasticity (varying variance) can lead to unreliable predictions, affecting the Regression model's accuracy.

While Correlation is typically used for bivariate analysis (involving two variables), Regression can be extended to multivariate analysis, involving more than two variables. Multiple Regression considers multiple independent variables, allowing for a more complex analysis of the relationships between variables. It enables the examination of how several predictors collectively influence the outcome variable, offering a more comprehensive understanding of the data.

Regression Analysis often assumes that the residuals (the differences between observed and predicted values) are typically distributed. This assumption is crucial for hypothesis testing and confidence intervals. Correlation analysis, being a non-parametric method for measuring association in variables, does not rely on this assumption. Therefore, Correlation can be a preferred method when the normality assumption is in question.

In Regression, the coefficients of independent variables provide valuable insights into the relationships. For instance, in a linear Regression equation, a positive coefficient indicates that the dependent variable increases as the corresponding independent variable increases. The size of the coefficient quantifies the magnitude of this change. Correlation, being a single number, does not provide this detailed interpretation of the relationship.

Correlation analysis can handle missing data by excluding pairs of observations with missing values. Regression Analysis, especially when involving multiple variables, requires careful handling of missing data. Techniques like multiple imputation or specific Regression methods designed for missing data are often applied to ensure the accuracy of Regression results.

Correlation specifically deals with numeric variables. It quantifies the linear relationship between two numerical variables. Regression, however, can handle both numerical and categorical (non-numeric) variables. Techniques like dummy coding or one-hot encoding are employed to convert categorical variables into a format suitable for Regression Analysis.

Regression is focused on predictive accuracy. Regression models are optimised to minimise the difference between observed and predicted values. In contrast, Correlation does not aim for predictive accuracy. It is more concerned with describing the strength and direction of the relationship rather than accurately predicting future values.

Outliers, or extreme values, can significantly influence both Correlation and Regression. However, Regression is more sensitive to outliers than Correlation. An outlier in Regression Analysis can distort the Regression line, affecting the accuracy of predictions. Correlation, being a rank-based measure in some cases (like Spearman’s Correlation), is relatively robust to outliers.

Regression can capture non-linear relationships through techniques like polynomial Regression or non-linear Regression models. It can model curves and complex patterns in the data. On the other hand, Correlation, being primarily focused on linear relationships, might not capture the nuances of non-linear associations between variables effectively.

Regression models can vary in complexity. Simple linear Regression involves one independent variable, while multiple Regression incorporates several predictors. Additionally, Regression Analysis can include interaction terms, allowing for the examination of how the relationship between variables changes based on the values of other variables. Correlation, however, being a single coefficient, is conceptually more straightforward and needs to account for these complexities.

Regression Analysis allows for hypothesis testing related to the coefficients of the independent variables. Analysts can test whether specific variables significantly contribute to the model. Correlation, on the other hand, does not involve hypothesis testing directly related to the Correlation coefficient itself. The importance of Correlation coefficients can be tested, but it does not provide the same depth of insight into the relationship as Regression.

Interested to learn Data Science and Analytics? Then sign up now for our specialised course on Data Science Analytics. Unlock your potential now!

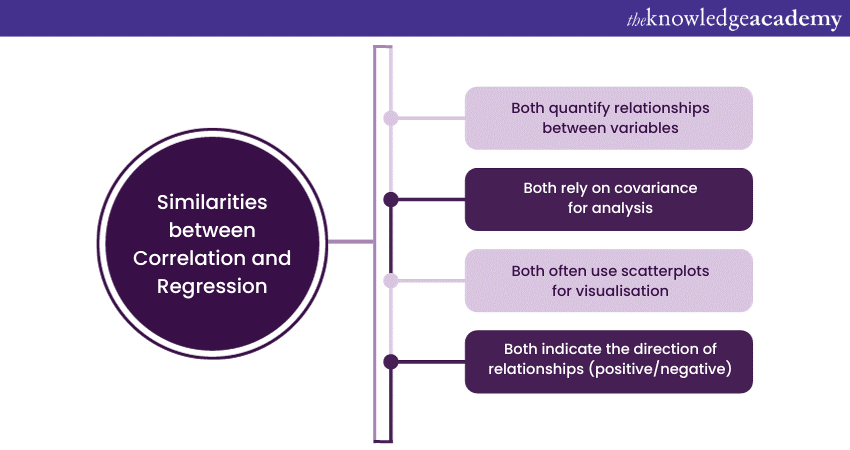

While Correlation and Regression differ significantly in their goals and methodologies, they share several fundamental similarities in their statistical foundation and applications.

Both Correlation and Regression aim to quantify relationships between variables. Correlation assesses the strength and direction of linear relationships, providing a numerical measure (Correlation coefficient) that ranges from -1 to +1. Regression, while also evaluating relationships, goes further by estimating the impact of changes in one variable on another through Regression coefficients.

Both Correlation and Regression rely on covariance, which measures how two variables change together. Covariance serves as a foundational concept, allowing statisticians to understand the direction of the relationship. Correlation, in particular, is essentially a normalised version of covariance, providing a standardised measure of association.

Both Correlation and Regression often employ scatterplots as visualisation tools. Scatterplots help depict the relationship between variables graphically, providing a visual representation of patterns that can aid in understanding the nature of the Correlation or Regression.

In both Correlation and Regression, the sign, whether it is positive or negative, shows the direction of the relationship. A positive sign signifies a positive Correlation or a positive Regression coefficient, meaning that as one variable increases, the other tends to increase as well. Conversely, a negative sign indicates a negative Correlation or a negative Regression coefficient, suggesting that as one variable increases, the other decreases.

We hope that you have learnt the differences between Correlation vs Regression. With these differences in mind, you can now implement them accordingly to understand the amount of data that is generated every day. Understanding these shared aspects and overall comprehension of both Correlation and Regression will help you in your analysis.